Olympia Update

There he goes again: Governor wants more taxes

December 24, 2020

OLYMPIA–State law requires the governor to put a budget proposal on the table for legislators to consider, and that typically happens at this time of year. After seeing what Governor Inslee wants in a new state budget for 2021-23, and how he would pay for it, I was reminded of what my political hero Ronald Reagan said to Jimmy Carter in a debate during the 1980 presidential campaign: "There you go again."

The state budgets run two years at a time–a biennium–so this is the fifth time Inslee has proposed a biennial budget. It's also the fifth time his budget would require new taxes to balance. Going 5-for-5 is quite a streak for someone who told the voters in 2012, when seeking his first term as governor, that he didn't see the need for new taxes.

With the 2021 legislative session less than a month away, I'm getting more invitations to talk–all "virtually"–about what to expect. On Monday I met with the Pasco Chamber of Commerce. The next day it was a brown-bag lunch with the Washington Retail Association, and a meeting with the Pullman City Council, Lewiston Tribune. Wednesday had me giving an update to one of my favorite organizations, AgForestry. I didn't have the governor's budget proposal in hand for any of those, or my pre-session visit Wednesday with the Lewiston Tribune and Moscow-Pullman Daily News, but I was able to mention it this morning when Rep. Dye, Rep. Schmick and I "Zoomed" with the Lewis Clark Chamber of Commerce.

The Legislature is not required to adopt anything he proposes, but it's already clear that at least two of his tax proposals will be introduced by Democrats in the House.

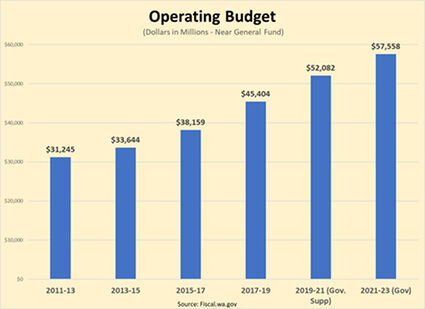

Inslee wants 10% increase in government spending, despite pandemic and fragile economy

You'd never know from looking at the new Inslee budget that our state is still dealing with a pandemic. The state economy was severely wounded by his stay-home order and "nonessential" dictate, and it's still fragile, but it has rebounded enough to avoid a budget deficit. Instead of being thankful for that and proposing a budget that stays within existing revenue, which would give families and employers time to recover from the economic fallout, the governor wants a $5.5 billion hike in spending. That's more than a 10% increase, and he wants $1.2 billion in new taxes to back it up–along with pulling $2 billion out of reserve, which means completely draining the state's rainy-day fund.

Governor Inslee is proposing to use $200 million from the rainy-day fund for "early action" pandemic relief: half for business assistance and half for rental assistance. I realize $100 million sounds like a lot, but considering how Washington employers are being faced with collectively paying 10 times that amount in 2021 to help refill the unemployment-insurance trust fund, it really won't provide much relief to employers statewide. It's too little, too late, and another reason that we should have had a special legislative session months ago to work on pandemic relief when it would have helped more.

I see it differently: We have a balanced budget now, so there's no deficit to address, and the revenue projections show we could produce a new budget that is balanced without new taxes and also makes reasonable investments in pandemic-related needs–like more support for mental-health services–without touching the rainy-day fund. Then we could look at using rainy-day dollars to make a real difference on relief for employers, whether it's tax relief, regulatory relief or even cash relief.

Another run at a state income tax

As long as the Internal Revenue Service views capital-gains income as taxable income, any state tax on capital-gains income also has to be viewed as an income tax. Over the years we've seen majority Democrats do their best to find some other name–even calling it an "excise" tax, which is false.

The governor said he will again pursue a state tax on income from capital gains yesterday, December 17, and he again denied it's an income tax, and instead called it a "constitutional exercise of legislative authority."

The nonpartisan Washington Policy Center captures this nonsense well in an article authored by Jason Mercier, Director for Government Reform, Tri-Cities: "Governor says capital gains tax not an income tax. Rest of the country disagrees."

Inslee and his allies in the majority know good and well that approving a state income tax, no matter what they prefer to call it, will automatically mean a court challenge. They figure approving the tax this year means it will work its way through the court system sooner.

Besides trying to mislead people about whether the capital-gains tax is really an income tax, Inslee was also misleading yesterday when he flatly stated additional revenue is "absolutely necessary." That's hogwash. But then, as I've said for years, Inslee never met a tax he didn't like.

A 'gas tax without roads'

The passage of the "Connecting Washington" transportation package in 2015 was one of the highlights of my time as Senate majority leader. There's a reason it was supported by two-thirds of the Senate and 60% of the House, which is a heavily bipartisan vote–because it did such a good job of investing in projects in all four corners of the state (and most everywhere in between). As with the previous transportation packages passed by the Legislature, the state gas tax provides the lion's share of the money. At least people can see the results.

Once again, the governor is pursuing what he calls a "clean fuel standard." It's also known as a low-carbon fuel standard, or LCFS. No matter what it's called, this is a fuel tax AND a carbon tax. It would raise the cost per gallon by perhaps 57 cents, yet do nothing to improve roads.

Governor Inslee can talk all he wants about taxing the wealthy to help families with lower incomes–this is not even close. It's more like a tax on rural Washington, because folks in rural areas tend to drive longer distances for everyday reasons. Our 9th District ranks 39th out of the 49 legislative districts in median income, at under $55,000 annually. A carbon tax like the LCFS hits people at that income bracket a lot worse than the Puget Sound folks whose median income is more than $100,000 annually. People in the Puget Sound area also have less cause to drive long distances for daily needs and are less likely to have oil heat.

The balance between Republicans and Democrats in the Legislature didn't change in the November election, but some of the older Democrats were basically replaced by younger Democrats, and Inslee seems to think that will mean more support for this form of social engineering. We'll see. I would expect the same level of opposition from the private sector, especially from employers who are barely surviving now and have no interest in paying higher fuel costs for no visible benefit.

If Biden is involved...well, that's different

This week our state's Electoral College electors met in the Senate chamber to cast their votes for president and vice president. The job of presiding could have easily been handled by Secretary of State Kim Wyman, but the governor must have insisted on being in charge because the votes would be cast for President-elect Joe Biden...and as of Monday, Inslee still had a shot at being appointed to the Biden cabinet (that is no longer the case).

You can't tell from the TVW coverage how many people were present in the Senate chamber, but there are 12 electors, and Secretary Wyman, and the governor, and probably some staff members for each, so let's say...20 people in all. Why do I bring this up? During the fall, Inslee rejected an invitation to meet in person with members of our Senate Republican caucus–an invitation we made because we felt he should be listening to Republican legislators as well as Democrat legislators about responding to the pandemic.

The obvious conclusion is, Inslee is OK being in the Senate chamber with other people if Joe Biden is the reason, but not to talk with Republican senators who represent millions of Washington residents. The same goes for the Democrat-selected Senate administrators who are forcing us to conduct the 2021 legislative session remotely, regardless of whether we have reliable internet access.

State auditor finds Employment Security Department lacked controls to prevent massive unemployment-benefits fraud.

When I was Senate Republican leader/Majority leader we dealt with scandals at the state's largest psychiatric hospital (Western State, in Pierce County) and the Department of Corrections (the erroneous early release of inmates) but this year's fiasco at the state Employment Security Department has to top those. Since March my office has been flooded, and rightfully so, with messages from constituents looking for help in getting unemployment benefits, because ESD was doing such a poor job of processing claims. Then it came to light that the agency had lost hundreds of millions to overseas scammers by paying on fraudulent claims. Lately a number of people began receiving notices that they had been overpaid and needed to repay the state!

The state auditor got involved, and today brought the first report from her office. Click here for the auditor's announcement and here for a news report. I continue to be disappointed by the governor's response to the scandal, but then again, the ESD commissioner wasn't appointed by him because of her experience in this field–she's a well-known partisan fundraiser. This is an issue that will carry over into the legislative session, as it should.

I welcome your comments about anything in this newsletter and questions about what I'm doing on your behalf in the state Senate. Please call, email or write using the contact information at the end of this report.

Legislative E-mail: [email protected]

Legislative Phone: (360) 786-7620

Toll-Free: 1 (800) 562-6000

Olympia Address:

314 Legislative Building

P.O. Box 40409

Olympia WA 98504-0409