Two levies on February special election ballot

January 26, 2023

POMEROY–A replacement Educational Programs and Operations (EP&O) levy for four years, and a six-year Capital levy will be on a special February 14, 2023 ballot for voter approval in Garfield County. Funds from the 2019-approved four-year EP&O levy and the capital levy will expire December, 2023.

Ballots will be mailed on or before January 27.

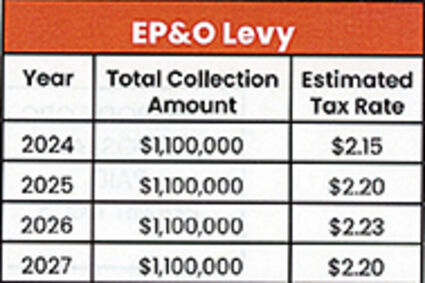

The Pomeroy School District has two separate measures on the February 14, 2023 special election. The four-year EP&O levy (2024-27) which will collect $1.1 million per year; with an estimated tax rate of $2.15 and will pay for educational programs and staffing.

The Board of Directors of the Pomeroy School District passed two resolutions that local voters will see on this upcoming special election ballot. The funds from each type of levy are required to be used for specific purposes, making it necessary for the school district to run both an EP&O and a Capital levy.

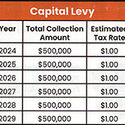

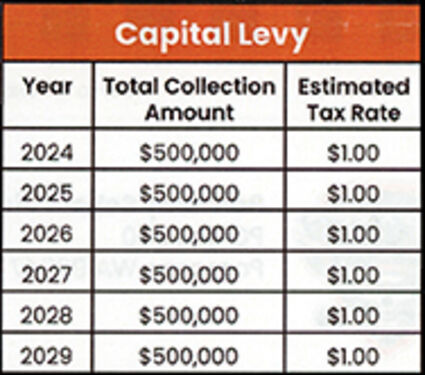

The six-year Capital levy (2024-29) will collect $500,000 per year at an estimated tax rate of $1 per $1,000 of assessed valuation, which will fund building and campus renovations and improvements.

The EP&O levy is to make up the difference between money provided by the state versus what it actually costs the school district to fund student programs and services. An EP&O levy may be approved for up to four years.. If approved by local voters on February 14, the 2023 ER&O levy will simply replace the expiring levy.

So, what does Pomeroy's EP&O Levy provide? It will ensure coverage of certificated and classified staff salaries and benefits; athletics; extracurricular activities including clubs such as FFA, FBLA, FCCLA, welding team; transportation for events including sports and field trips; School Resource Officer (SRO); smaller class sizes, staff training, and school counselors. It will ensure technology services and instruction, textbooks and curriculum; facility maintenance and upgrades; heating, lighting, classroom supplies, and custodial supplies.

The Capital levy is used to fund things like modern technology, and smaller building and renovation projects. This levy may be approved for up to six years, and, if approved, would pay for projects across the school buildings.

The Capital levy will cover new elementary playground; sidewalk replacements and both school; new elementary roof; replacement lights at the football field; placement of asphalt at the football parking lot, and more.

Here are the tax calculations:

The Educational Programs and Operations Levy is proposed at $1.1 million per year from 2024-27. The EP&O levy tax rate is estimated at $2.15 per $1,000 of assessed property value beginning in 2024.

Pomeroy's Capital Levy is proposed at $500,00 per year from 2024-29. The Capital levy tax rate is estimated at $1 per $1,000 of assessed property value beginning in 2024.

2023 Pomeroy Levy Quick Facts

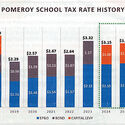

The above graph shows the tax rate history for the Pomeroy School District No. 110 since 2017. In addition, the Pomeroy School District Bond will be paid off December, 2023. And, the EP&O rate increased between 2022 and 2023 due to the land valuation decreasing as well as a change to the amount the school district is allowed to collect.

The Pomeroy School District No. 110 receives a majority of its annual funding to educate students from the State of Washington. However, state and federal funding sources do not cover all costs of quality educational program for students. School districts across the state rely on levies to help cover the remaining costs needed to maintain programs for both students and schools.

-Edited by Charlotte Baker